HOUSTON HOUSING MARKET

The Houston housing market has long been tied to the economic welfare of the oil industry. Although this is still true, the Houston economy has diversified and is not as dependent as past decades of history. Thus, the Houston housing market is more robust than the past years.

New construction in Houston has sustained steady growth despite the low price of oil these past several years. This is far different than the past decades of oil price cycles Houston experienced and was tied to. The past oil market corrections left new construction and the Houston housing market specifically in Houston running for cover and property values stifled for years.

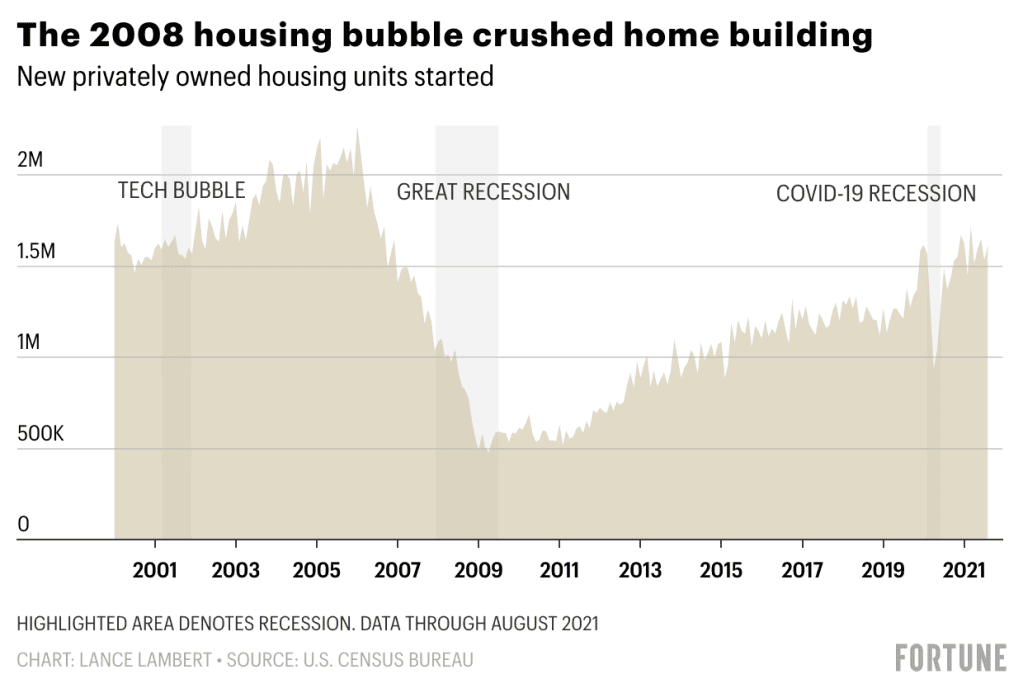

It is generally accepted that the nation as well as Houston has been experiencing a housing inventory shortage for the past decade. This began in the 2008 financial crisis that thrust the housing market into a recession.

Learn about the sales, starts, and economic conditions that affect the Houston housing market in 2023

During the period 2008 through 2019, builders’ production levels were far less than historical levels. It took a decade to reach a sustained home production level of the early 2000 years.

Housing Construction Starts Statistics

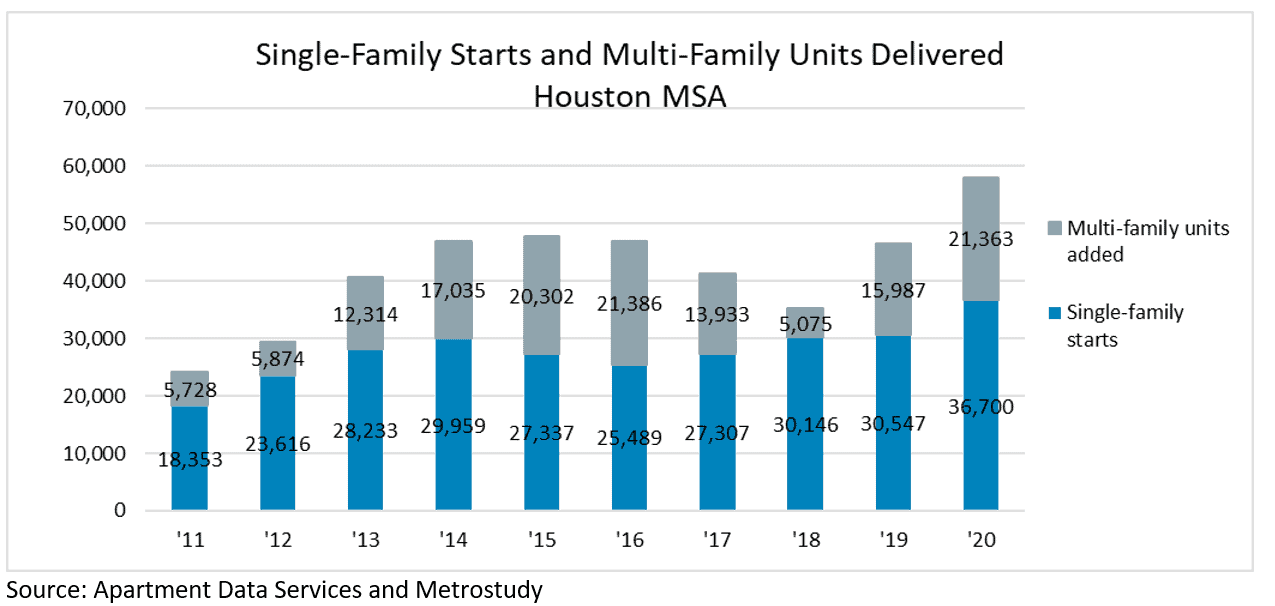

The past several years Houston housing starts have reduced from an estimated 64,000 in 2014 to a respectable estimated 45,000 in 2016. After leading the nation in housing starts 2012 – 2014, Dallas has dethroned Houston in 2015 & 2016 as the leading city in starts, according to the US Census.

According to the Greater Houston Partnership , during 2016 the actual single family home starts were approximately 26,000 leaving the remaining starts in multi-family and attached housing, such as condos and townhomes. Total adjusted housing starts in Houston were approximately 41,000 in 2017, 35,000 in 2018, 46,500 in 2019, and 58,000 in 2020.

The Houston housing market’s new construction consists of both single-family detached, single family attached, and multifamily housing. Single family home starts typically represent about 3/4 of Houston’s annual housing starts while multi-family annual starts make up the difference.

The total amount of the 2019 housing starts (46,500) represents a valuation of approximately $8.4 billion to the Houston local economy. The total amount of existing homes sold in Houston during 2019 annually was in the neighborhood of 80,000+ according to Forbes. This represents approximately $30 Billion in transactions.

The historical results suggest that the existing single-family homes sold annual in Houston have an annual range of approximately 50,000 – 70,000 homes.

Despite the beginning of COVID, the Houston housing market experienced a record year of new home sales amounting to approximately 96,000+ in 2020, according to the Houston Business Journal. New construction amounted to in excess of 58,000 housing starts for this same period according to Metro Study.

Houston housing market hit an all-time high sales volume of 130,000 units in 2021, according to HAR as reported by the Houston Chronicle. Interestingly enough not only did the Houston housing market establish a new sales benchmark in sales volume, but home sales prices climbed 15% in comparison to 2020.

The new construction Houston housing market consists of 23% of the total sales of home sales in the Houston housing market. The remaining Houston housing market consists of resale homes (70%), REO sales (5%), and foreclosures (2%).

Single family homes in Houston are typically grouped into multiple price segments. The MLS uses ($100k – $250k), ($250k – $500k), ($500k – $1M), ($1M +). They also distinctively classify housing as townhomes, condos and single family homes for these same price groupings.

Houston Home Sales Prices

Houston home sales prices are a consequence of supply and demand, as well as other local economic factors such as interest rates, employment levels and population migration.

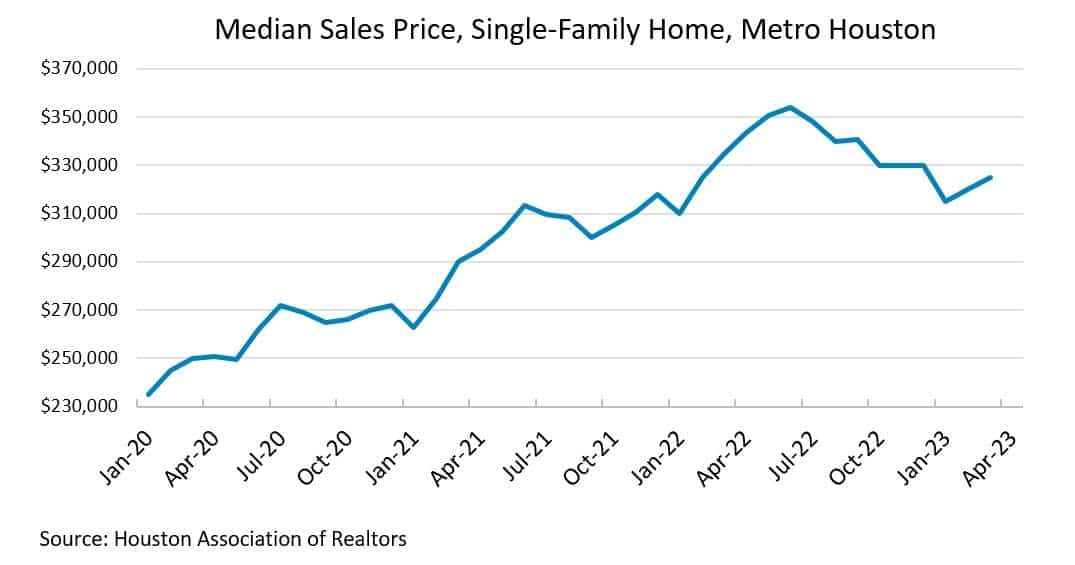

As the HAR graft represents, home sales prices have been increasing more than 30% in the Houston housing market in the last 3 years. This was due to mortgage interest rates being the lowest level in history, a shortage in the national housing supply, and a pandemic that placed additional pressures on the supply chain.

Further investigation indicates that rising home prices have retreated since the high point in September 2022. The FED has aggressively started raising interest rates in an effort to reduce the runaway inflation that also characterized this period. These trends have continued into the first part of 2023.

Metro Houston Housing Market Factors

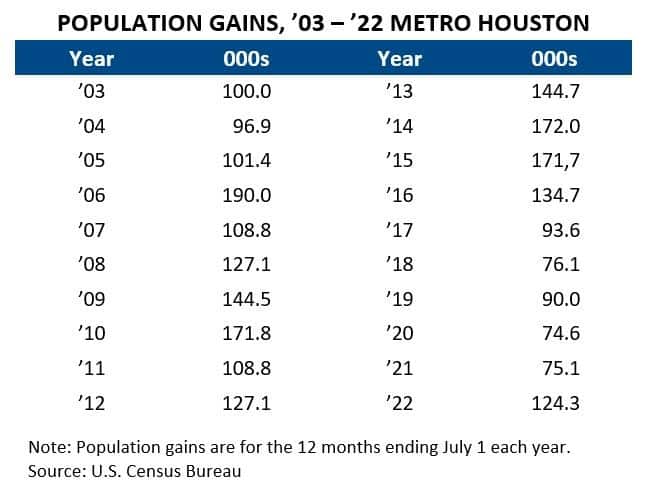

According to the Greater Houston Partnership, the projected Houston population trends suggest that Houston will continue to add between 100,000 – 150,000 people annually to the overall population.

This growth trend is predicted by historical migration patterns established and adjusted from the past 15 years. The growth in Houston is attributed to a number of factors such as lifestyle affordability, job growth, housing cost, and a steady flow of Fortune 500 companies expanding in the region.

Much of the Houston population growth can be attributed to the abundance of job employment opportunities. During periods of higher oil prices, there is enormous pressure on labor needs in Texas. This demand results in a larger amount of migration to Houston to seek employment.

This condition has been a developing trend since the 1970s due in part to the presence of all the major oil companies. In recent times, oil prices have fallen close to pre-1998 prices.

Although oil prices are not expected to rise dramatically for some time due to the abundance of oil inventory, Houston has a strong enough business commerce to continue to grow and attract professionally skilled and semi-skilled labor for the foreseeable future.

Houston Land Prices

The vacant lot inventory in Houston continues to shrink, placing increasing price pressure on older homes for the value of the land. This in turn adds more cost to new housing due to the land price component.

Land cost traditionally represents between 20% – 35% of the total infill housing construction cost. It is this factor that has led builders to construct higher density housing in the past decade. There is no reason to believe that this trend will not continue.

The shortage of vacant lot inventory also contributes to rising price pressures on metro area new construction cost of higher end homes. The land prices for buildable lots in finer neighborhoods have more the doubled in the past decade.

As previously suggested this place greater pressure on rising new construction cost and ultimately trickles down to resale home prices. The cost of new construction has a profound economic impact on all housing during high and low demand housing periods.

It is due to many of these factors that have sustained home and land values even during major economic downturns in the past several decades.

Houston Housing Market Pandemic Behavior

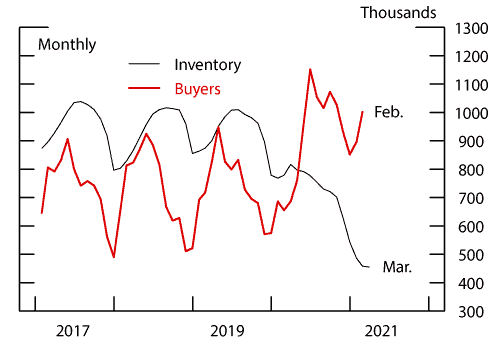

The current housing inventory levels shift with the supply and demand of sellers and buyers. As oil prices have softened some of the market demand for higher-end homes over the past several years, the lower end of the housing has picked up a great deal of steam in Houston. The demand for new construction continues to be brisk.

Houston has increased the total number of new housing starts 8 consecutive quarters, after a 33% decrease in starts after oil prices plummeted in 2014.

In most US cities this type of dramatic drop would cause a huge spike in inventory levels. This is not the case, rather Houston’s housing market was so hot in 2013 – 2014, that in fact, the current level of the general housing inventory has placed the market in a stage of equilibrium.

The term equilibrium is used to suggest that there are as many buyers as there are sellers. Hence the market economics are balanced. Currently, the high-end market is referred to as soft, while the lower-price end is strong.

The volatility of the housing market and general statistics provide us with an indication of future trends. In Houston, the new construction housing trends are very positive and suggest continue growth for the future.

The biggest impact on the local housing supply was the pandemic. During the 12 – 18 months of the national pandemic, manufacturing of supply chains was interrupted. This caused a huge interruption in an already tight housing supply.

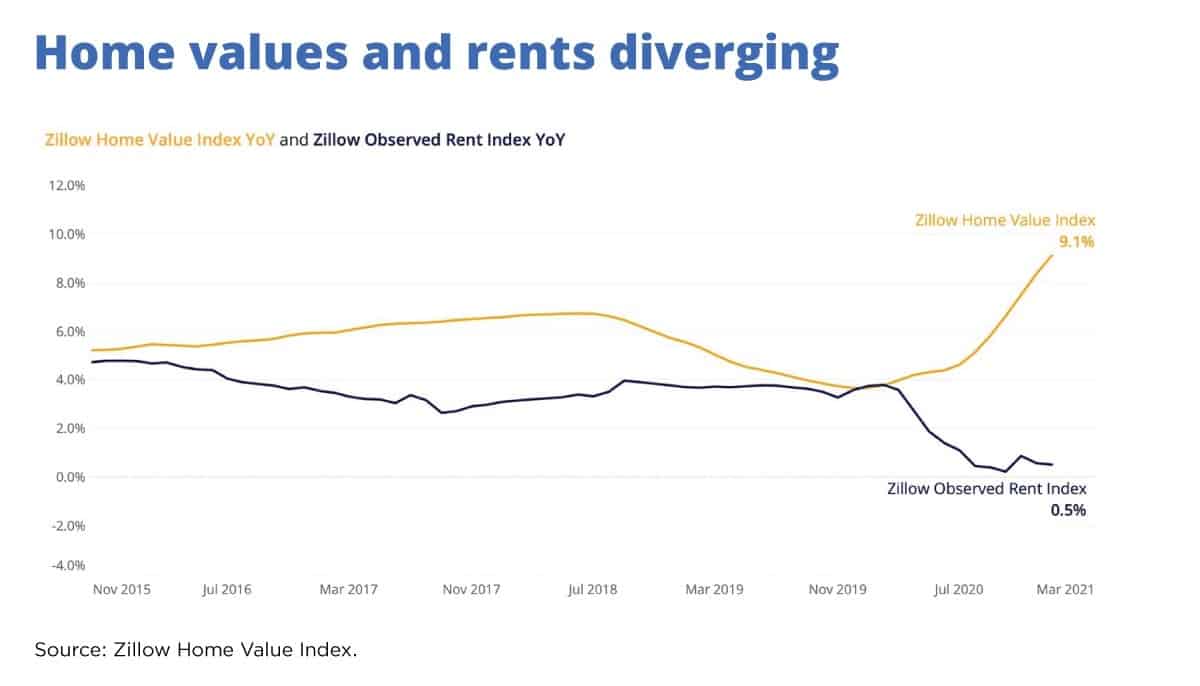

According to Bloomberg, the pandemic contributed to the rapid increase in home prices over the past 2 years. Consequently, the home pricing explosion has had a profound effect on rental prices as well. These consequences are due in part to people not being able to afford homes. This is represented by the graph below presented by Zillow. The period after March 2021 experienced rents following home prices.

Houston Housing Market Projections

The Fed has intentionally raised prime mortgage rates to cool off price inflation on all commodities according to the New York Times. This action has seen mortgage rates more than double in the past 12 months. Higher interest rates have softened the demand for housing.

According to US News, the escalating home appreciation that we have experienced in Houston will stabilize, but this will not fix the housing inventory shortage any time soon. Between the population migration to Houston and steady employment rate, housing demand will remain greater than home supply.