The new tax bill has been signed into law at the end of 2017. It has made significant changes to the former tax law by considerably reducing the individual and corporate tax rate. The most noteworthy changes came in the form of the limitations our legislators placed on the mortgage interest deductions and property tax deduction. Texas property owners will not be effected by the reduction in state and local tax deductions for the obvious reasons. But the impacts from the unprecedented mortgage interest deduction and the property tax limitations on the future of the luxury homes market are unknown. We will look at the details of the new tax laws and the possible market consequences we might expect.

What are the Tax Bill Mortgage Interest Deduction Changes

The former tax law allowed all mortgage interest to be deducted from your taxable income. This applied to any amount of mortgage interest that the tax payer expensed in a given tax year. The new tax law now limits the mortgage interest deduction on home mortgages more than $750,000 for new purchases and $1,000,000 on existing mortgages. This cap on mortgages amounts applies to both new first home purchases as well as second homes purchased. Existing homeowners will be directly affected for first and second homes with total mortgages above $1,000,000.

What this means to new luxury homeowners is that if you have a mortgage of $1,000,000 you will pay an additional $3,700 in federal taxes each year. This amount of additional tax is not likely to have a measured effect on the long term viability of the luxury home resale market. To qualify for a $1,000,000 mortgage, the owners would be required to have an annual income in excess of $180,000. The additional $3,700 is not likely to deter a potential homebuyer from the right home for their family.

What are the Property Tax Deduction Changes

The new tax law now caps the itemized personal deductions for property tax from taxable income at $10,000. This limitation will not likely have much effect on home values less than $500,000. The major impact will be felt by Houston homeowners with home values north of $750,000. At the current tax rates in Harris County a homeowner with a home assessed at a value of $750,000 would pay approximately $15,000 in property taxes. This means that one third of the property tax expense will no longer be tax deductable.

This tax law change may well have a considerable affect on the future market values of Houston luxury homes. With an annual property tax of nearly $30,000 for a home value assessed at $2,500,000, homeowners may be less willing to pay the price for a luxury home in a premium location in metro Houston. In metro Houston the land values are frequently assessed at a higher value than the improvements on vintage homes. In metro Houston it is common to find lot values in excess of $1,000,000. This is likely to have some impact on the future demand for close in vintage homes and future new home lots for obsolete homes.

What are the Capital Gains Tax Changes

There were no changes to the capital gains taxes for the sale of a principle residence. The capital gains tax still excludes the first $500,000 for joint tax returns from the sale of the home. For single filing homeowners the capital gains tax excludes the first $250,000.

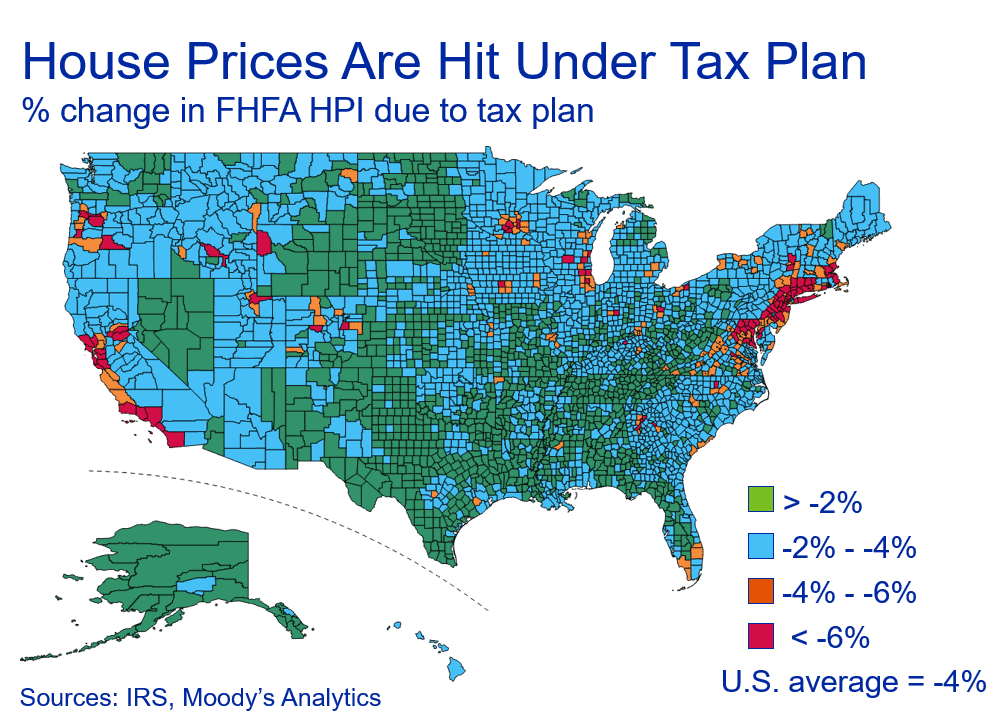

How are Higher End Home Values Affected

Cities like San Francisco, San Diego and New York City that have a large percentage of high end homes to total homes will experience a greater impact on the overall housing market. These major cities and others in states like California, Florida and Connecticut will likely be the first locations to experience the consequences of Congress’s recent actions.

Houston home values above $500,000 represent about 6.5% of the total homes according to Zillow. The rippling effects of the new tax law will likely take some time before the permanent results can be measured in Houston. These consequences are also likely to have an impact on the housing industry as well as the home sales brokerage industry.

Possible New Tax Law Consequences

Although the future of the new tax laws affects on luxury homes is unclear at this point, there is little doubt amongst real estate experts that there is indeed a high likelihood that the luxury home markets will be permanently effected. The conversation is about how they will be effected and how these changes will consequently effect the long term value of luxury homes and the supporting industries. Another question is how do these changes effect the general housing industry.

There will always be buyers for new luxury homes in major housing markets. The question is how many fewer buyers will there be in both the short term and long term. With luxury homes representing such a small share of the housing market in Houston and most cities, there is a very good chance that prices will temporarily fall and luxury homes will likely take a longer time to sell. This would be the natural economic response to lower demand brought on by the loss in tax advantages for higher end homes.

There is also a probable reaction of existing homeowners remaining in their homes for longer periods of time to continue to enjoy the full benefits of the former tax law enjoyed by the grandfather clause implemented by Congress. This would likely increase the demand for home remodeling and lessen the demand for new luxury home construction. Luxury homeowners that are required to relocate may elect to lease their homes to renters in order to maintain their properties tax deductibility benefits.

One might expect that there will be some impact on the general housing market and sales brokerage business. We can expect some immediate downward pressure on home prices above $1,00,000 and a reluctance of existing homeowners in homes valued at $750,000 trading upward. Although the longer term outlook could be very favorable for demand for homes priced in the $500,000 to $1,000,000 price range. This would cause speculative custom home builders to move more resources to new home construction at this price point or close to it.

It is fair to say that the luxury home market as we know it will likely change in the years to come. Until clever tax accountants and high net worth homebuyers develop a tax effective method to shift ownership into a business structure to avoid the consequential affects of the new tax law, the luxury home market is sure to experience a substantial change in the future.